The car insurance quotes blog 0923

AboutThe Single Strategy To Use For Average Car Insurance Rates By Age & Gender - The Motley ...

Adding teenagers in specific can increase the rates as they are amongst the most unskilled motorists. Some of that can be balanced out by completing a driver's education or defensive driving program, and many insurance business offer a "good trainee" discount rate. The argument that a teen driver need to get a separate policy with less coverage to keep costs down overlooks a number of potential problems- chief amongst them that in numerous states the moms and dads are still lawfully responsible for their child's actions- particularly if they are still minors- and therefore the moms and dads could still be sued for their kid's actions behind the wheel no matter whether the teenager motorist has a different policy.

Another situation many families face is how to handle several children in your home who are driving. Consider the example of moms and dads with 2 children, one who is 19 and her 17 year old sibling. Assume that when the child turned 18 the parents chose to put her on a different policy to conserve cash- one with less protection than their own, figuring she didn't have almost the properties that they did.

What this implies is that while the restriction may not use to the parents, it does use to any other family member who is generally covered by their policy- in this case the 17 year old son. If the more youthful brother were to obtain his older sis's vehicle and get into a mishap, he would have protection under her policy, but it would just be for whatever protection was in his sister's policy.

The Only Guide for How Much Is Car Insurance For An 18 Year Old?

W When thinking about whether to put a teen chauffeur on a different policy parents must weigh brief term cost savings on premium versus the ramifications having a loss might have on their family's financial resources. Defensive driving courses, excellent student discount rates and developing safe driving practices that result in decrease rates on renewal are ways to minimize the problem of adding teenager motorists and their automobiles to a moms and dad's car policy.

com, or call 800-696-3947 and ask for Christine O'Keefe.

(And if you're guaranteeing your teenager on your policy, you have actually already taken something of a hit so you're just taking on another cars and truck and designating your teenager as the driver.) Here are some things to consider: What type of cars and truck would you buy? While it's a subjective choice with numerous variables to think about, you might wish to consider the impact your choice will have on your car insurance rates.

6 Simple Techniques For How To Save Money On Car Insurance For Teens - The General

However if you choose you wish to go the hybrid vehicle route, make certain to explore whether there is a hybrid discount rate available. You will likewise desire to talk to your insurance provider before you purchase to make certain the vehicle you're thinking about will not cost an arm and a leg to guarantee because of its reputation as being pricey to repair.

You may get a discount for a vehicle that isn't overdoing the miles or used in a prolonged work commute. Bundling methods buying more than one kind of insurance coverage from the very same business. So, for example, where offered, you could acquire Check out here both your home and your car coverage from the exact same insurer and generally that company will provide you a discount on one or both policies.

Have you gotten other quotes? Generally, having three automobiles guaranteed with the same company will cost less than splitting them up, but with a teen driver, that's not a provided. If including the third vehicle with your teen as the main chauffeur is too expensive, review your coverage to make sure it is the very best value for your coverage.

Not known Facts About Florida Kidcare - Offering Health Insurance For Children From ...

In fact, you may get back at more of a discount if all of the chauffeurs in your house take the defensive driving course. Ask your insurance company what that might provide for you. Good trainee discounts are out there, too. If your teen is making great grades in school, he or she also might certify for a discount for that as well.

.jpg)

Associated Products & Discounts Get protection that can provide you peace of mind when you're on the road. This discount rate is offered to motorists who maintain a B average or its comparable, or are in the upper 20% of their class scholastically. Age restrictions use. This protection provides and spends for covered towing and labor expenses if your automobile breaks down.

As the moms and dad or guardian of a young chauffeur, you know it's vital to have good automobile insurance coverage to safeguard them. Whether you're spending for it or they're striving to bear the expense, it's a new expense for your family. You can discover inexpensive automobile insurance coverage for young drivers without breaking the bank.

The Ultimate Guide To Buy The Cheapest Car Insurance For 18 Year Old Drivers In ...

Nevertheless, if your teenager does have a luxury vehicle, it may be cheaper for them to be on their own cars and truck insurance plan, since possibilities are the insurance coverage premiums will be significantly greater than other cars within your policy. It may likewise make more sense for them to acquire their own policy if either parent has any DUIs or several moving offenses, as adding a teen chauffeur can make the current policy expense a lot more.

While doing so will increase your insurance rates, your policy's protection and deductibles will likewise apply to your teenager. You may likewise have the ability to conserve cash by signing up for a multi-car insurance coverage. A greater car insurance coverage deductible might decrease the rate, but could suggest more out-of-pocket costs after a mishap.

Getting the best protection that best fits your needs is very important for saving money on your teen's vehicle insurance coverage. Find out more about Nationwide's auto insurance protection types today.

More About Car Insurance For 18 Year Olds In Ireland - Quoteme.ie

Car insurance for 18 year olds To drive on UK roadways, you need to have cars and truck insurance coverage no matter how old you are. Young chauffeurs are far more most likely to be associated with mishaps than drivers aged 25 and older, indicating premiums can be some of the greatest. If you can't afford your own policy, you could be a called motorist on another individual's vehicle.

If you get those points within 2 years of passing your driving test, you can also have your licence taken away. Young motorists around the age of 18 are more likely to be involved in an accident and make a claim.

Taking your car to a hectic university town and parking it on the street can increase the risk of damage or theft which can raise premiums too. If you're 18 and have built up one years' worth of no claims discount, then fortunately is that so long as you continue going, premiums are more than most likely to come down.

6 Easy Facts About Do You Have To Add Your Teenager To Your Car Insurance In ... Described

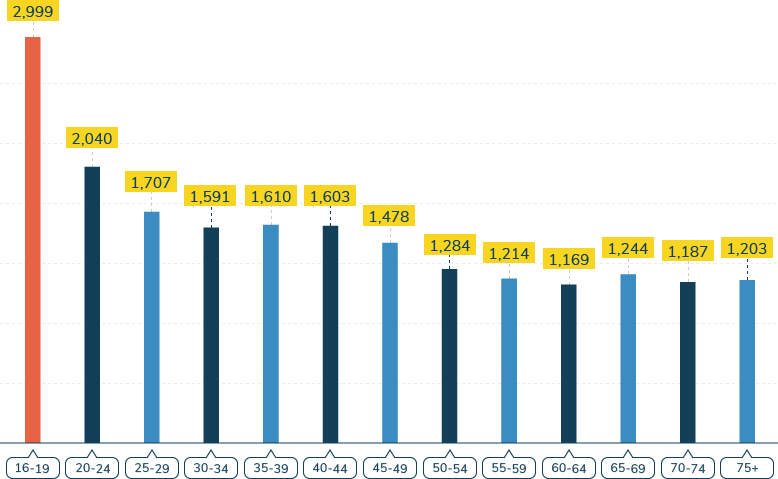

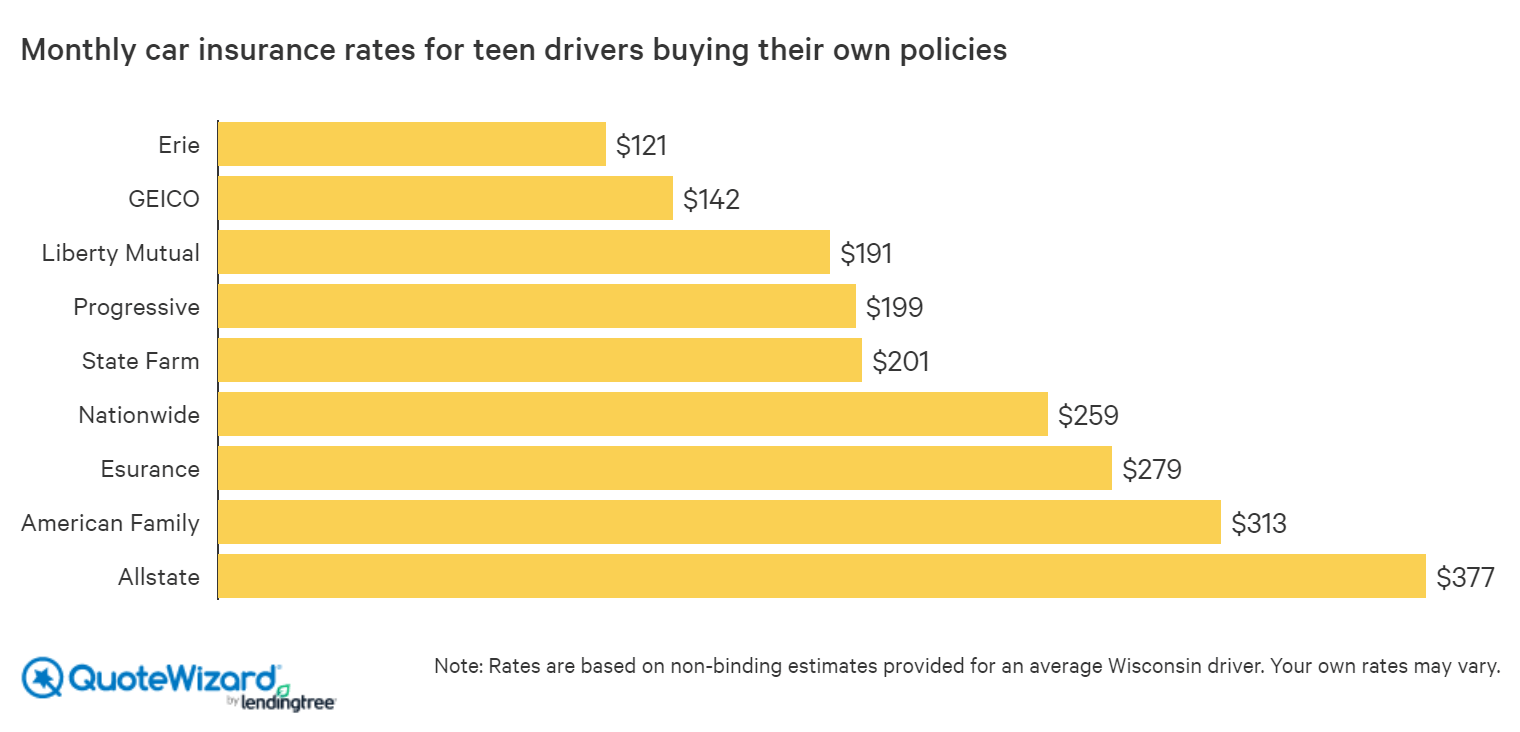

https://www.youtube.com/embed/zp6_s0B2dmwOur findings reveal that the typical national rate for a teenage chauffeur is just shy of $6,000 each year, or $500 a month. Even the cheapest cars and truck insurance coverage for teenagers is much greater than the rates priced quote for more experienced drivers. That stated, these numbers show the expense of a teen having their own auto insurance coverage policy.

AboutNot known Facts About Tips For Saving With Teen Driver Discounts - Bankrate

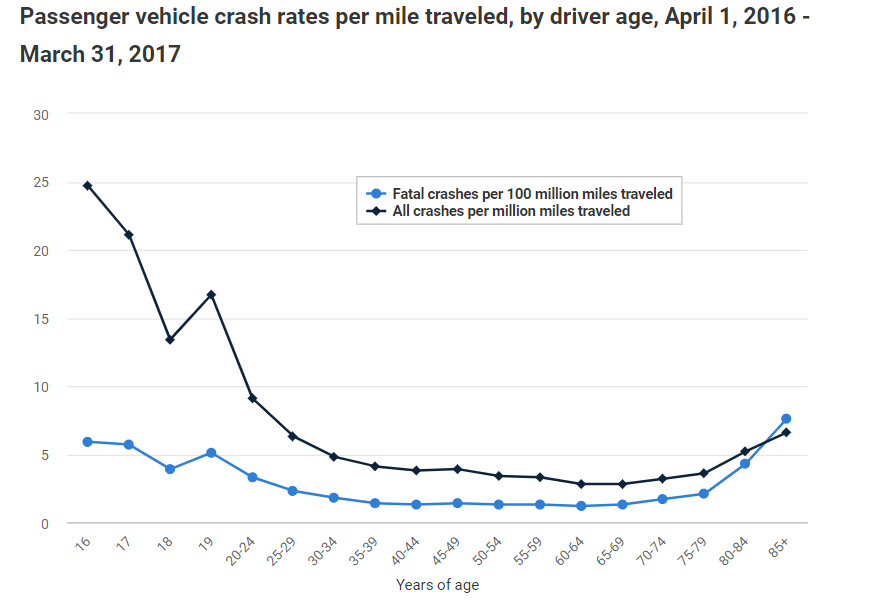

Inexperienced teenagers are more most likely to enter into mishaps, and according to the Centers for Disease Control and Prevention, the leading cause of death for teens is motor automobile accidents. Every day, 6 teenagers in between the ages of 16 and 19 will die due to a motor vehicle crash. With greater rates, you need to take your time when shopping automobile insurance coverage for teens.

The majority of auto insurance business provide a family discount rate or lower rate when guaranteeing several lorries. Another reason to add your teenager to your policy is to receive coverage no matter what automobile they drive.

These elements figure out the majority of the cost: Teenager drivers have less experience behind the wheel and for that reason position a higher threat. Due to the fact that credit reliability is an outstanding gauge of obligation, premiums increase the lower the credit rating is. Regrettably, most teenagers don't have a credit rating, which continues to put them at a disadvantage.

Things about 6 Tips To Lower Insurance Costs For Your New Teen Driver

This lack of history makes it challenging for the cars and truck insurer to determine how high of a danger each person poses. To secure itself, the company charges more than average to compensate. Driving a cars and truck with a good security ranking and advanced safety technology assists to reduce the rate.

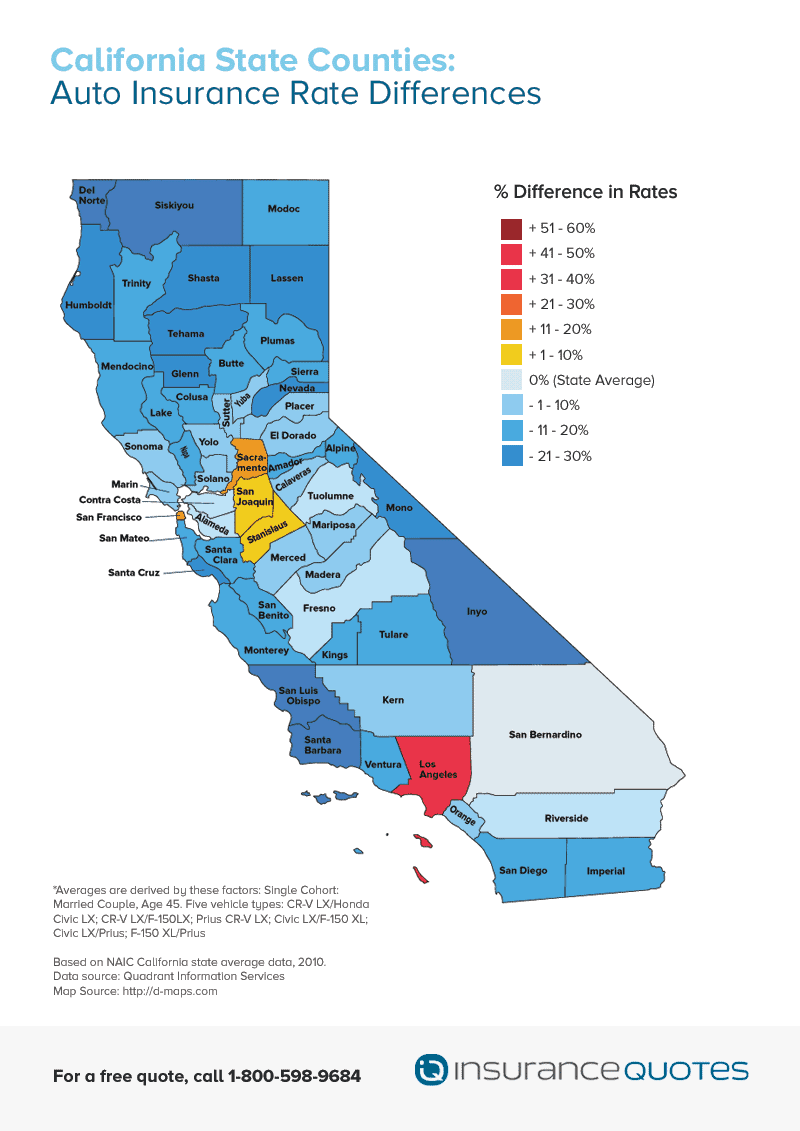

Where you live plays a substantial role in your premium. If you live in a city that puts you at risk for vehicle theft, you will see higher rates than those in a rural location. Required protection likewise varies by state. According to U.S.A. Today, Women tend to pay less than guys for car insurance coverage during the teenager years.

The insurance coverage business factors in the level of security you want. If you pick the highest strategy, you will pay more. In addition, your deductible will alter the cost of your premium. How To Get The Cheapest Vehicle Insurance Coverage For Teens Fortunately, there are actions you can require to ensure you get cheap cars and truck insurance for young drivers.

The 30-Second Trick For What's The Best Way To Insure A New Teen Driver? - Experian

If your teenager won't be driving for a portion of the year while away at school, make certain you inform the service provider to receive a lower rate. Some full-time trainees can make a discount rate for the months when there isn't any active driving. Some providers now have apps and special gadgets that enable for the monitoring of your teen's driving habits.

Final Ideas On The Finest Cars And Truck Insurance For Teens When it pertains to saving money on a teen car insurance plan, it might be appealing to reduce the level of protection. While this is a way to conserve money in advance, think about the implications if your teenager enters an accident.

Method In an effort to provide precise and unbiased information to consumers, our professional evaluation group gathers data from lots of auto insurance suppliers to formulate rankings of the very best insurers. Business get a rating in each of the following classifications, as well as a total weighted rating out of 5.

How How To Add A Teen Driver To Your Car Insurance - Reviews.com can Save You Time, Stress, and Money.

When your kid stops having fun with toy vehicles in the bedroom and starts the ignition on a genuine cars and truck in the driveway, it's time to begin thinking of two huge things: security and insurance coverage. It's real. Car insurance coverage rates tend to increase when you include a teen chauffeur onto your policy or purchase a different policy for a teenage chauffeur.

If you resemble the majority of moms and dads, you may be asking yourself these crucial questions today: How am I going to keep my teenager safe on the roadway? How can I decrease the cost of insuring a teenage driver? Let's begin and assist you discover the responses! Keeping your teenager chauffeur safe Some states need teens to finish a chauffeur's education course from a state-approved instructor or organization.

In either case, it's extremely recommended that your teenager chauffeur completes a motorist education course to better learn the rules of the roadway and how to stay safe. Another thing that varies state-by-state is teen driver regulations, so be sure to discover yours. Teenager driver policies normally consist of rules such as driving only at certain times of the day or night, having only a certain number of travelers in the automobile or ensuring there's a driver of a particular age in the automobile at all times.

The Facts About Teenage Driver Discounts - The Balance Revealed

Finally, speak with your teen driver about the risks of distracted driving and inspect out new innovation that can disable texting and social networks on cell phones while the automobile is in motion. Make sure to coach your teenage motorist on how to stay mindful while driving, avoid diversions and evaluate prospective dangers while running their lorry.

Your teenager can typically have his/her own insurance coverage if the car is titled in his or her name. But considering that many states will not allow chauffeurs under age 18 to title their own car, your only option might be to add your teenager onto your own policy. While you have your agent's ear, ask him or her about additional ways you might have the ability to save money while guaranteeing your teen chauffeur, such as: A several vehicle discount if you're insuring several cars, including your teen's vehicle, with the very same insurance coverage provider.

The more traffic offenses and at-fault accidents they have, the more points they accumulate and it's most likely their vehicle insurance rates will increase, too. Teenager chauffeurs can also expose their families to expensive personal or property damage lawsuits if they cause damage that falls beyond the covered limits in the cars and truck insurance plan.

What Does How Much Does It Cost To Add A Teenager To ... - Creditdonkey Do?

https://www.youtube.com/embed/Um1_tf_FO3sThe excellent news is that without any significant moving violations or mishaps, the cost to guarantee a teenage motorist can gradually decrease over time. So, if you and your teen always put security first, then you can stress less about keeping them safe and insured. Speak with your regional independent Grange agent to find out more about insuring your teenage motorist.

AboutThe Buzz on 5 Ways To Help Lower Auto Insurance Rates - Military.com

Try to find modifications, You 'd be shocked to find out the number of people are paying for household chauffeurs that have not lived in the house for years. Or sometimes, home members such as teenagers and young people might have aged out of more costly coverage and now certify for less expensive automobile insurance coverage.

Raise your deductible, If you're a regularly safe chauffeur, you'll likely never require to submit an insurance claim or pay a deductible. If you're not knowledgeable about the deductible, it's the amount you pay of pocket before your insurance provider pays the remainder of the claim. Most policies have a deductible of approximately $500.

Insurance providers desire more of your organization, and they reward you for having numerous lines of protection or even having more than one vehicle on a policy."Inspect out what the top insurance companies will offer you when you opt for multi-line discounts or bundling.

Ensure you're comparing service providers by similar policy criteria. Check out the fine print on the quotes to make certain the limitations, dangers covered and deductible quantities are the exact same. If you find that changing vehicle insurance coverage could save you significant money, do a little research study about the business prior to you act.

See This Report about Brochure: Lowering Your Auto Insurance Costs - Kraft ...

Your present insurance provider might provide to match the more affordable automobile quote (or offer you with a larger discount rate) to keep your service. Other considerations and ways on how to decrease vehicle insurance The fast fixes to drop your cars and truck insurance now work but a long-term technique is required for insurance coverage savings gradually.

In this article: In the current monetary unpredictability surrounding the COVID-19 pandemic, you may be taking a look at different ways to cut your costs. One way you can conserve cash is by decreasing your car insurance premiums. With less Americans on the roadway, some vehicle insurer are providing a broad variety of discount rates, some of which will let you start saving money instantly.

Contact Your Insurance Coverage Agent, Start by contacting your existing vehicle insurance provider to ask how you can cut your premiums. Have a copy of your insurance plan ready so you can see precisely what your existing coverage consists of. The insurance coverage agent need to be able to suggest numerous choices.

Learn what additionals your policy includes and eliminate the ones you can live without. Choose the Right Vehicle, If you remain in the market for a new car, understand that the cost of insurance coverage can differ extensively depending upon your vehicle. Some cars are more complex to repair, more prone to theft or more easily damaged than others.

Brochure: Lowering Your Auto Insurance Costs - Kraft ... Fundamentals Explained

https://www.youtube.com/embed/XSxlH6ESC9QIf you're leasing a car, it could be a good concept to get space protection, which pays the difference between the worth of the car and the amount you owe on your lease in the occasion the car is taken or amounted to in a mishap. No matter how much you're currently paying for cars and truck insurance coverage, evaluating your insurance coverage every year could assist you determine methods to save.

AboutThe Greatest Guide To Best Cheap Car Insurance For Teens Of October 2021 - Forbes

2. Do Not Text and Drive, Ever, Around 40% of teenagers confess they've been a guest in an automobile where the motorist used a cellular phone in a way that put them in threat. You don't want your teen to be that chauffeur. Make sure they comprehend even reading a text at a stop indication or stoplight is unsafe.

3. Limitation Mobile Phone Usage, It's not simply about texting using a cellphone quadruples your risk of a car crash. Set guideline for what is and isn't appropriate when it concerns using a mobile phone in the vehicle. Will you ask your teenager to pull over to make and get telephone call? The choice is up to you just make sure your teenager understands the threat.

What Does How To Save On Your Teen's Auto Insurance - Cbs News Do?

Limit Discussion With Passengers15% of teenager crashes are the result of diversion due to connecting with travelers in the automobile. Will you restrict the variety of passengers your teenager can have in the cars and truck in the beginning, while they are still finding out to master the fundamentals of driving? If your teenager will have passengers, are there practical standards you can set for limiting interaction while the automobile remains in movement? 5.

Remind your teen that it's essential to keep their eyes on the roadway. Turn Down the Music, Image the stereotyped young person driving with music blaring, belting out their preferred tunes.

The Definitive Guide to Best Car Insurance For Teen Drivers: How To Save On Your ...

The freedom that includes a chauffeur's license makes it tempting to blast music and sing along, but the truth is loud music can obstruct of being in tune with your surroundings. It is essential for your teen to keep the music turned down low and to book the singing for the shower.

In the U.S., six teenagers pass away every day usually due to automobile injuries. To avoid mishaps from happening, motivate your teenager to practice safe driving routines and invest lots of time supervising them when they're behind the wheel. Supervise your child driving in lots of various environments so they develop the driving skills needed.

Should You Add Your Teen Driver To Your Car Insurance ... Can Be Fun For Everyone

It is necessary that teens are supervised driving in various climate condition so they know how to drive at a safe speed for the roadway conditions. Interruptions: Sidetracked driving is comparatively as harmful as impaired driving. Teenagers might be most likely to get in an accident if using a cellular phone or if transporting peers.

We're a regional, family-owned insurance coverage company with more than 20 years of experience. We focus on getting our customers the lowest rate on the market, while providing them with options that guarantee their liability protection is enough to protect their assets.

Unknown Facts About Car Insurance For Young Drivers And Teens - Usaa

It is very important to call your agent to check. Ray Crisci, senior vice president and around the world auto supervisor for Chubb Personal Insurance, alerts moms and dads that they may not be covered if their teenager gets in an accident before they have been formally included to the policy."My finest guidance is to call your representative or insurance coverage service provider when it's time to add a teen chauffeur to your auto insurance plan.

You're not purchasing higher limits for your teenager's properties you're buying the greater limits for your own security. He keeps in mind that if moms and dads raise their coverage levels and raise their deductibles, they may not contribute to their overall premium expense. The deductible is the amount you need to pay out of pocket if you have a collision or comprehensive claim.

6 Simple Techniques For Insurance For Teens - Country Financial

Insurance coverage expenses for a teenage driver, Lots of moms and dads are already running on tight budgets. The preliminary expense to include a recently certified teen chauffeur can be as much as 3 or 4 times what an adult chauffeur would pay, states Crisci. The high premiums show grim stats: Motorists ages 16 to 19 are 3 times more most likely than chauffeurs age 20 and older to be in a deadly crash, according to the Centers for Illness Control CDC).

Trowbridge also encourages parents to include their teenager to the policy on the family's earliest automobile."They need to still be able to drive any car in the household, however you want to have them ranked chauffeur on the least expensive car in order to save money," says Trowbridge.

9 Simple Techniques For How To Save On Car Insurance For Teens

Be proactive in asking your representative to look for car insurance coverage discounts for you. Have your teen ranked on the oldest automobile in your household. If you're buying an automobile for your teenager, choice something huge and sluggish, with the current safety features.

Vehicle Insurance Coverage for Teens The majority of teenagers can not wait till they learn how to drive, get their license and hit the open road. Sadly, finding auto insurance can show to be difficult. Having actually been in this position themselves, every driver can comprehend the difficulties of discovering the ideal cars and truck insurance coverage but the challenges can be intensified for young motorists.

Not known Incorrect Statements About Car Insurance For Teens & Young Drivers: Cheapest And Best ...

However, there are methods to keep young driver insurance costs lower, such as including them to an existing policy, looking for discount rates they get approved for and teaching them safe driving habits that will ultimately cause cost savings. Cars and truck insurance plan for young chauffeurs No matter what state you live in, having young chauffeur insurance coverage is a must.

A lot of insurance companies have special automobile insurance coverage for young drivers. Some parents add extra protection when they look for cars and truck insurance coverage for teenagers as a safety measure.

What Does How To Lower Car Insurance For A Teenager - Shopping Guides Do?

https://www.youtube.com/embed/d4Hxtuoq6oAThe majority of vehicle policies will cover teenagers with a learner's license that are driving the automobile of an adult in the exact same home, but it's never ever a bad concept to validate protection with your vehicle insurance coverage supplier. The majority of insurance companies will need licensed drivers-- even teens-- living in the exact same home to be covered.

AboutIndicators on Car Insurance For First Time Drivers - Confused.com You Should Know

The quantity of cash you'll avoid depends upon the type of policy you're signing up with, along with how it is billed. If you are being added onto a preferred policy, the holder might have to pay a greater premium to cover you. However this may not go into result till the next billing cycle.

When a New Driver Can't Join an Existing Strategy It might not constantly be possible to be added as a motorist on someone else's policy. There are a couple of factors that work versus new chauffeurs.

As discussed above, newer chauffeurs will also pay high-risk rates given that they don't have a history of insurance coverage. While unusual, there are cases when a brand-new driver might save cash by getting their own policy. This may take place, for example, if a teen motorist drives a cheap vehicle, however their parent drives a high-end vehicle.

Getting The How To Shop For Car Insurance To Get The Best Deal - Business ... To Work

Tips for Cutting Expenses Joining an existing plan isn't the only method for new chauffeurs to minimize insurance coverage. Here are a few more ideas that can assist, whether or not you can be included to another person's plan. Search Do your research study and get quotes from lots of various insurance provider.

To save time, you may likewise be able to find companies that offer quotes from multiple business simultaneously. Just make certain that if you use this technique you get approved for the offers. Pay in Complete Many cars and truck insurance Click here for info coverage business will offer a discount rate for paying 6 months' worth of premiums at the same time.

It might not be easy to save up that much money for a one-time payment, however you will conserve cash in the long run if you have the ability to do it. Store Again in Six Months When you have kept continuous insurance for 6 months, it's time to start looking for a more affordable rate.

10 Simple Techniques For Car And Auto Insurance Quotes Online - Usaa

Six months of protection might be all you need to switch your status from high-risk to a preferred, and that might be the biggest savings you will ever see in premiums. You may be able to protect lower rates if you can show that you're a great trainee, or have a steady task.

Assist from a friend or household member can make the search a lot easier, but it isn't the only way to get covered. If you're on your own, remain strong, and stay with the plan. With a little research study and calling around, you'll discover protection you can pay for prior to too long.

Getting car insurance coverage for the very first time? Purchasing a vehicle can be interesting - and a little bit scary. There's responsibility - choosing what protection and deductibles you want and require, to call just 2 examples - and flexibility as you move from a moms and dad or caretaker's policy to one that's all your own.

7 Simple Techniques For A Beginner's Guide To Buying Car Insurance - Cbs News

The very first thing to comprehend about car insurance is that there are a range of aspects that can influence coverage and cost. Age, marital status and home ownership are just 3 identifying aspects. And what kind of protection (and deductible) you desire needs to a mishap occur may likewise help you identify the policy and criteria you pick.

You can utilize it to access a copy of your insurance policy, report a claim, pay your expense and contact your agent. Look for "State Farm mobile app" either through i, Tunes or Google Play. What Are Possible Auto Insurance Coverage Discount Rates To Inquire About? Your agent can direct you through possible ways to minimize your vehicle insurance coverage, including: Great student: conserve as much as 25% for excellent grades Safe chauffeur: no at-fault accidents or moving offenses for three years Driver training: finish an authorized motorist education course Away at school: utilizing the vehicle only while home throughout school getaways and holidays Documents To Give Your State Farm Representative's Office To establish your own cars and truck insurance coverage, you'll need: A legitimate chauffeur's license Savings account info Lorry details, including the VIN number (usually found on the dash near the bottom of the windscreen or inside the motorist's door), make, design and year Loan details Once you have actually developed your policy, schedule an insurance review a minimum of as soon as a year to go over policies, changes and needs.

Failure to do so could subject you to expensive charges and fines as well as traffic tickets, higher premiums in the future, and even the suspension of your license. How to Get Car Insurance Coverage for the Very First Time, When you're driving a car for the first time, you do not have present car insurance.

The Ultimate Guide To When To Cancel Car Insurance After Selling A Car - J.d. Power

As an outcome, you'll have to pay a greater premium than a preferred or basic chauffeur with proven experience. One method around this greater expense is to be included as a new chauffeur on an existing insurance plan. By going this route, you can get an instant discount rate on your premium.

Nearly every state has its own policies around insurance coverage for motorists. In all states however New Hampshire, you need to have liability protection on your automobile insurance plan. In 20 of the 50 states, you should carry uninsured driver protection, while 17 states need motorists to carry underinsured motorist protection. The minimum coverage quantities also differ in between the states.

Ask your family and friends members who they utilize for automobile insurance and carry out an online search to see what business show up in your location. Create a list of a couple of to compare and examine their problem stats and evaluations. Problems are available through the National Association of Insurance Coverage Commissioners' Consumer Info Source, while evaluations are readily available through lots of online sources.

Things about 4 Tips For Buying And Insuring Your First Car - Geico

You must constantly get numerous quotes to compare rates and choices. Ensure the quotes you acquire are for the very same coverage levels so you're comparing apples to apples. If you don't desire to connect to each business for a quote, you can utilize a side-by-side contrast tool to see rates from multiple carriers.

com. Now that you have a concept of what you may spend for car insurance coverage, the next action is calling an insurance agent. You will need to work with an agent to acquire your policy, and they can also help ensure that the strategy you're checking out has all the coverage choices you require.

https://www.youtube.com/embed/QkVHsmlla9w

As pointed out, all states but New Hampshire need this protection on an automobile insurance coverage. Another kind of protection is collision, which is what will spend for repair work to your automobile if you are associated with a crash with another car or you hit a things, such as a wall or post.

AboutSome Known Incorrect Statements About 6 Reasons Why Auto Insurance Costs More For Young Drivers

Being such a high-risk group generally implies teenagers pay higher rates for vehicle insurance. The very best way to discover cost effective automobile insurance for a 17-year-old is by putting them on a parent's policy and search for trainee and young chauffeur discounts. Because 18-year-old chauffeurs do not have much experience behind the wheel, these motorists are considered high-risk.

According to The Zebra's State of Vehicle Insurance coverage research study, the typical automobile insurance coverage for 18-year-old drivers runs about $4,700 each year or almost $400 each month. The very same study talks about the cost savings 18-year-olds can see if they remain on their parents' insurance plan rather of beginning their own it's about $2,600.

Teenage drivers pay some of the greatest rates, though there is a huge difference in between the typical expense for 16-year-old and 19-year-old drivers. According to Forbes, adding a teen chauffeur to a couple's car insurance coverage increases rates by an average of 79 percent. However that number is up to about 58 percent once the motorist turns 19 years old.

What Does Sos - Teen Driving Risk Awareness - State Of Michigan Do?

* You may observe that some vehicle insurance provider are noted above those with higher star ratings. This is since our scores take into account nationwide aspects, while our ranking for this short article looks particularly at what vehicle insurance service providers are best for teenagers. Liberty Mutual has the best vehicle insurance coverage for teenagers because of its thorough coverage and benefits.

State Farm is a leading provider of auto insurance, as well as insurance for bikes, boats, ATVs, motorhomes, and more. State Farm has some of the finest cars and truck insurance for teenagers thanks to its fantastic programs for trainees and young motorists.

Drivers more youthful than 25 without any at-fault mishaps or moving offenses in the past three years who complete this driving training program might save as much 15 percent on their policy. If you are a student under the age of 25 and move away to school without bringing your car, get a discount rate on your cars and truck insurance rates.

The Facts About Average Cost Of Car Insurance For Teens - Quotewizard Uncovered

To find out more, read our complete State Farm insurance coverage review. USAA made the greatest rankings in general in our market evaluation for all chauffeurs, and teens can get terrific rates too. If you are currently employed or part of a military household, it makes sense to use this supplier for your teenager's insurance coverage requirements.

In reality, the coverage doesn't end when your kid moves away from house and is all set for their own policy. USAA has a 10-percent Household Tradition discount when the time comes for your kid to get an individual policy. Read our USAA insurance coverage review for more information about why this company has some of the very best vehicle insurance for teenagers.

It is among the top insurance service providers in the nation. Geico preserves an A+ BBB ranking, and it likewise prospered on the very same 2021 J.D. Power study discussed above. As some of the very best car insurance coverage for young people, we like Geico for its long list of discounts and incentives.

The Definitive Guide to Tips For Adding A Teenage Driver To Your Auto Insurance

Car Insurance Coverage Study, however the advantages this company uses make it a top contender for the very best cars and truck insurance for teenagers. Progressive is one of the biggest insurance coverage companies in the country and has actually stayed in business considering that 1937. It presently sits in 74th put on the Fortune 500 list.

Some advantages to utilizing Progressive when selecting automobile insurance coverage for teenager motorists consist of: Discount rate Details Only spend for security when the vehicle remains in use (i. e. if your kid disappears to school without the lorry). Get lower premiums if your teenager keeps a B average or greater. Conserve cash when you insure several cars.

Rather of shopping with multiple companies, you can simply use the cost contrast tool used by Progressive to see the rates of contending business. It's not unusual to find a lower rate with another company as an outcome of this tool. That level of transparency is difficult to discover in the insurance coverage market.

The Main Principles Of Teen Driver? 10 Ways To Get Discounts On Car Insurance

AAA is known for more than just roadside support and car rental discounts. With your membership, you can receive low insurance premiums even when your teenager is consisted of on the policy. AAA automobile insurance coverage is widely regarded as a leader in the market and keeps an A+ BBB score.

Unskilled teenagers are most likely to enter accidents, and according to the Centers for Illness Control and Prevention, the leading cause of death for teenagers is automobile mishaps. Every day, 6 teenagers between the ages of 16 and 19 will pass away due to a motor automobile crash. With greater rates, you require to take your time when shopping vehicle insurance for teens.

Obviously, this does increase your yearly premiums however conserves your kid cash. Most auto insurer provide a household discount or lower rate when insuring several cars. Another reason to include your teen to your policy is to get protection no matter what vehicle they drive. If your teenager is associated with an at-fault accident, it will not matter which among the covered automobiles was harmed.

The 5-Second Trick For Teen Driving Statistics - Rocky Mountain Insurance ...

These elements figure out most of the expense: Teenager drivers have less experience behind the wheel and therefore position a greater risk. Since creditworthiness is an exceptional gauge of responsibility, premiums increase the lower the credit rating is. Unfortunately, most teens do not have a credit history, which continues to put them at a drawback.

This absence of history makes it challenging for the car insurer to determine how high of a risk everyone positions. To safeguard itself, the supplier charges more than average to compensate. Driving a cars and truck with a great safety ranking and advanced safety technology helps to lower the rate.

If you live in a city that puts you at threat for vehicle theft, you will see higher rates than those in a rural location. According to USA Today, Women tend to pay less than guys for vehicle insurance throughout the teen years.

Some Of Teen Driver? 10 Ways To Get Discounts On Car Insurance

https://www.youtube.com/embed/dVDhYtQkuO8The insurance coverage business factors in the level of defense you desire. If you select the highest plan, you will pay more. In addition, your deductible will modify the cost of your premium. How To Get The Cheapest Vehicle Insurance Coverage For Teens Fortunately, there are steps you can require to guarantee you receive cheap car insurance for young drivers.

AboutAn Unbiased View of Don't Get Cheated On Your Car Damage - Nelson Macneil ...

Bottom line, An accident is never ever great for your car insurance policy, but that does not suggest you'll always have higher rates. Rate increases differ depending upon where you live and the type of mishap you caused. You also have the ability to lower your premium by picking a safe automobile to drive, enhancing your credit score, adjusting your policy and searching for protection for the very best offer.

These are sample rates and need to just be used for relative purposes. Rates were computed by evaluating our base profile with the following events applied: clean record (base), at-fault mishap, single speeding ticket, single DUI conviction and lapse in coverage.

Nevertheless, that does not mean that the repair work will cost more than the car's real value. With a totaled vehicle, the insurance business has chosen it is not worth the expense to repair it. Calculating the overall loss worth of a lorry is challenging to identify, and those computations may differ depending on the state and insurance provider.

The 7-Minute Rule for What Happens If My Car Gets 'Totaled' In An Accident? - Allstate

It can likewise assist provide you with the appropriate details to determine if you are getting enough to pay off your vehicle loan. Insurance business use lots of variables to identify the value of your car. A few of these factors consist of: High-end and classic automobiles are valued higher. More recent automobiles have a higher worth than older cars.

If the insurer determines that you may have added to the mishap in any method, they might decrease the total loss worth. This computation varies by state. It is necessary to comprehend your state's laws concerning contributory carelessness. Insurance coverage companies often utilize a percentage to determine whether the car is amounted to.

For example, if your automobile is worth $10,000 and the expense to repair it is $7,000, the insurance provider will likely total it. Here are some other things to think about for your car. The damage to a brand-new car needs to be severe for it to be totaled.

The smart Trick of Will A Collision Repair Shop Fix Your Totaled Car? That Nobody is Talking About

Insurer amount to older vehicles due to the fact that they have a lower resale worth than more recent cars. It is typically hard to find replacement parts for older cars, and it may be costly to install those parts. If your vehicle is amounted to, the insurance coverage company will pay you the vehicle's worth prior to the accident.

Some automobile repair work training schools might buy trashed vehicles for students to utilize for practice. You may have heard about the term "real cash value." If you could sell your lorry prior to the accident, the real money value is what you would get for the vehicle. A lot of conventional vehicle insurance coverage cover vehicles using a formula to figure out the genuine cash value.

There are some exceptions to the guideline. Lots of classic vehicles can prevent being considered amounted to. You also may not face a total loss if you have additional coverage on your vehicle, such as space insurance coverage. There are some things that your insurer will utilize to identify the real worth of your car.

A Biased View of What To Do If Your Car Is Totaled After An Accident

If your automobile is in exceptional condition, it will have a greater real value than an older and worn cars and truck. However, you require to remember that vehicles can rapidly diminish. Even those small mishaps can cause insurance provider to declare your cars and truck to be an overall loss.

There are a few ways you can get a concept about your cars and truck's value. Compose down the year, make and design of your cars and truck, and the mileage at the time of the mishap.

Many claims adjusters will tell you that insurance coverage business do not pay claims based on the Kelley Blue Book values. You may likewise desire to inspect out the classified ads to see automobile costs in your location.

Our After An Accident - Nc Doi Diaries

This need to give you a worth close to what the insurance business will offer. For any of those upgrades, you must keep track of your receipts.

There are a couple of words of care when handling an insurer. It is not unusual for many car owners to get a total loss payment check less than the overall of your vehicle loan quantity. These scenarios can take place in several different methods. Your car can diminish faster than the rate you are paying down for your loan.

For the most part, the lender will be compensated first, and any remaining money will be launched to you. If you wish to avoid owing cash on your amounted to car, there are a couple of things that you can do to prevent this circumstance. You must think about collision or comprehensive protection.

The Main Principles Of How Much Will My Insurance Pay If My Car Was Totaled?

For many owners who are renting or financing their cars, these 2 separate protections are needed on your car insurance plan. If your cars and truck is already settled, then these policies are optional. Nevertheless, if your vehicle is totaled without these protection plans, then you may need to pay out of pocket to acquire a replacement lorry.

Vehicle accidents are never enjoyable but if your cars and truck is severely damaged in a fender bender you might be stating farewell to your ride. Will your car go to the body shop or the scrap stack?

Key Highlights, The total loss limit is the portion at which an insurance provider need to lawfully state that a cars and truck is an overall loss and request a salvage title. The percentage differs from state to state. Twenty-two states use a total loss formula instead where they calculate the expense of repairs plus the lorry's scrap value.

The Facts About What Should I Do If My Vehicle Is Totaled? - Kelley Blue Book Uncovered

Insurance companies operating in multiple states have an internal approach of examining the total loss quantity to be constant regardless of where the automobile is situated. If your car is funded and you have gap insurance in place that policy will pay the difference in between the insurance coverage value of the car and your loan benefit quantity.

https://www.youtube.com/embed/V9W7LDYG5u0

Total loss: What does it suggest? What is a total loss threshold? This is the point where an insurance provider should lawfully state a car amounted to and look for a salvage title. The overall loss limit is set at the state level so it will vary depending on where you call house.

AboutShould Your Teenager Have Their Own Car Insurance Policy? Can Be Fun For Anyone

You may be able to get a discount on your policy if you finish an authorized driver training course, so you need to complete one as quickly as possible. Many insurance providers provide students a discount for preserving an overall B average or better. You may want to consider postponing owning your own cars and truck, if possible.

Consider the expense of insurance coverage prior to you make that down payment.

With this awareness comes the hard truth for many moms and dads when faced with including a teenager driver to their vehicle insurance coverage. A 2020 study by Coverage provides a sobering figure for moms and dads adding a teenager to insurance anticipate premium increases around 130% to include a 16-year-old teen chauffeur to the automobile insurance coverage policy.

How to Add a Teen Motorist to Your Cars And Truck Insurance, Follow these actions for including a teen chauffeur to your cars and truck insurance plan. Prior to your teenager gets their learner's permit, have a discussion with an insurance representative about when to add the teenager to the policy, when they get their authorization or when they get their driver's license.

Rumored Buzz on Teen Drivers - Nc Doi

The majority of insurance experts advise liability limitations of a minimum of 100/300/100. Ask the agent about discount eligibility for your teenager to help lower the expense of adding them to the car insurance. Get quotes from other car insurance provider to see who provides the best rates for your family when adding a teenager to the insurance coverage plan.

These programs normally come with a discount rate for getting involved, with an additional discount granted for safe driving practices. Each year or policy renewal, look around for quotes and ask about brand-new discount rates available so you can get the most inexpensive rates possible. How a Teenager Motorist Affects Car Insurance Premiums, Though the average expense boost for including a teen motorist to vehicle insurance is currently steep at about 130%, the cost might be even higher if the teen is male.

The teenager chauffeur safety and discount programs, there are a number of other discounts teens can be qualified for: Full-time trainees with a B or above GPA in school can receive a discount for having great grades in high school or college, as long as they are unmarried and under 25.

Parents can lead by example and use the app data to discuss safe driving practices with teen motorists while also keeping track of when and where they are driving when the moms and dad is not with them. Insurance coverage rates vary by make and model, so it might make sense to get a different vehicle. Parents might be able to drop detailed and accident if they purchase an older vehicle.

It pays to repair or replace an automobile harmed in an accident. If the teen motorist is involved in an at-fault mishap, there is no protection for the automobile without crash coverage.

The rate for a teen motorist might be higher or lower depending on place, gender, and coverage quantities. A teen ought to get their own automobile insurance coverage if they are on the title of the vehicle, however they may be able to be contributed to the moms and dads policy for a lower cost.

Making the most of discount programs is another method to save when adding a teen driver to automobile insurance.

Getting My Best Cars For Teens: Guide To Insure Cheap Cars For New Drivers To Work

Being unskilled behind the wheel of a cars and truck usually leads to greater insurance rates, but some companies still offer fantastic rates. Similar to for any other chauffeur, discovering the very best vehicle insurance coverage for brand-new chauffeurs means studying and comparing rates from several service providers. This guide will offer an introduction of what brand-new drivers can anticipate when spending for automobile insurance, who certifies as a new motorist and what factors shape the cost of an insurance coverage policy.

As discussed, age is one of the main things insurance provider take a look at when putting rates together. Part of the reason insurance provider trek rates for younger drivers is the increased possibility of an accident. Automobile crashes are the second-highest leading cause of death for teens in the U.S., according to the Centers for Disease Control and Prevention.

Adding a young driver to an insurance plan will still increase your premiums significantly, however the amount will depend on your insurer, the automobile and where you live. Teens aren't the only ones driving for the very first time. An individual at any age who has actually lived in a big city and mainly depended on mass transit or who hasn't had the ways to purchase a cars and truck might likewise be considered a brand-new driver.

Even though you might not have experience on the road, if you're over 25, you may see lower rates than new teenager drivers. Another thing to think about is that if you live in an area that has public transit or you don't intend on driving much, there are options to traditional insurance, like usage-based insurance.

Unknown Facts About Car Insurance For Teen Drivers - The Zebra

Immigrants and foreign nationals can be categorized as new chauffeurs when they first go into the U.S. This is since automobile insurance coverage companies normally inspect domestic driving records, so you can have a clean driving record in another country and still be considered an unskilled chauffeur after relocating to the States.

We suggest using the following methods if you're purchasing automobile insurance for brand-new chauffeurs. Compare companies No two insurer will offer you the exact same price on protection. Requiring time to compare cars and truck insurance coverage quotes will offer a baseline concept of what you can expect to pay when adding someone to an existing policy or just how much you could save by switching providers.

Our recommendations for vehicle insurance for brand-new chauffeurs Whether you're a brand-new chauffeur or have actually been driving for decades, looking into and comparing quotes from several suppliers is an excellent way to discover the best rate. Our insurance coverage professionals have discovered that Geico, State Farm and Liberty Mutual are exceptional options for automobile insurance for new chauffeurs.

https://www.youtube.com/embed/_RCiHO-GA2E

With programs like Steer Clear for motorists under the age of 25, we recognized State Farm as a great option for trainees. Plus, its network of regional agents can can be found in helpful if you're uncertain just how much protection to acquire as a brand-new driver. Regularly asked questions Our choices for the very best automobile insurance for new drivers are Geico, State Farm and Liberty Mutual.

AboutThe smart Trick of How Will My Insurance Company Handle My Totaled Vehicle? That Nobody is Disc

The finest method to prove a car's real value is through the viewpoint of a qualified appraiser. If you disagree with the insurer's appraisal of your car, you are going to need to work with a qualified appraiser to come up with a viewpoint regarding your automobile's value. Simply browsing the web and trying to utilize an online automobile value calculator won't suffice.

To find out more, please see our and An overall cars and truck loss is what takes place when the insurance coverage carrier determines it costs more to fix the damage than to fix your lorry. It's not always due to the fact that of a severe accident; your cars and truck might be amounted to since of a natural event.

The 4-Minute Rule for What Happens When Your Car Is Totaled? - Pinder Plotkin

What Happens When Your Car Is Totaled? A total cars and truck loss can occur in many scenarios.

The payout is based upon the reasonable market price, or Actual Money Value (ACV). If you have accident and detailed coverage alternatives on your auto policy, then your overall loss is paid out at ACV minus your deductible. ACV is simply a term for what was as soon as called the "book value" of the automobile, Miller discusses or the worth of your lorry when accounting for the devaluation that all vehicles begin sustaining as soon as they leave the lot.

The Basic Principles Of My Damaged Car Is A Total Loss -- What Are My Options? - Nolo

They will want to know if it's a loan, how much do you owe," Miller states. That's due to the fact that you may owe on the car more than the carrier pays out, or you may not be existing with payments on your car loan.

Gap insurance bridges the difference in between what you owe and the quantity of the payment from the insurance coverage provider. If you don't have this optional coverage in your policy, then you require to come up with the rest. If You Wish to Keep Your Cars and truck After It's Stated a Total Loss, If your insurance coverage carrier identifies your cars and truck is an overall loss, you might Click for info wonder if it's possible to keep your automobile.

About Frequently Asked Questions About Auto Insurance Claims

Does your state enable it? If you do mean to drive it, can it be totally fixed? Will your cars and truck pass an evaluation as soon as repaired?

File An Insurance Claim, The quicker you file your claim, the much better. The damage to your car might be higher than you realize, and the insurance provider need to be included from the start of the claim. Have Your Lorry Towed to an Approved Body Store"Your car does not need to go back to the dealer," states Miller.

The Basic Principles Of Auto Insurance Faqs - Insure U

"Gather Your Files, One of the most important steps is to keep in mind to gather your files inside the lorry., an insurance consultant and specialist with the Consumer Federation of America.

"Consumers must insist that they get all the expenses of changing the amounted to vehicle," Heller states."Of course the insurance coverage provider might not see the worth in your car the way you do, and the payout may not equal what it costs to purchase a new vehicle.

The 7-Minute Rule for What Happens If Your Car Is Totaled? - Experian

If You Are Leasing a Cars And Truck While Waiting Numerous motorists require a rental car while waiting for a choice on a payout, and usage insurance coverage to cover the rental expenses. However understand there is a limit to rental automobile coverage. After issuing your payment files, insurer will normally keep spending for the leasing for a "day or 2," Miller states.

If you owe more on the cars and truck than what you're provided, then you're responsible for the deficiency, unless you have space insurance coverage.

Some Known Factual Statements About Totaled Loss Car Insurance Settlement: How To Get More For ...

Hop in the motorist's seat and buckle up as we describe what it means when your cars and truck is amounted to, whether your insurer will cover a totaled vehicle and more. What Does It Mean When Your Automobile Is Totaled? A basic vehicle insurance coverage usually won't pay to fix your car if it's been amounted to.

It differs from another term you might have heard regarding vehicle insurance coverage: replacement expense worth. Replacement expense refers to what it would cost to purchase a brand-new cars and truck equivalent to one that's been totaled. Not all auto insurance coverage offer replacement expense as an alternative. Keep in mind that your vehicle insurance premium will be higher if you choose replacement cost value protection rather of real cash worth protection.

About How Much Will My Car Insurance Go Up After An Accident?

When you have an automobile loan or lease, those 2 types of protection generally are needed. They aren't legal requirements on a vehicle you have actually paid off, howeverthe choice to carry extensive or crash coverage is up to you. Without coverage beyond the liability insurance coverage that's required in nearly every state, you may need to pay of pocket to replace your amounted to vehicle (especially if you're at fault in the crash).

Crash insurance coverage uses when your cars and truck is harmed throughout a crash with another car, a things or residential or commercial property. In many cases, an insurance provider might not cover a claim when your car is a total loss. Here are five possible factors for your claim being rejected: You lack the proper coverage, such as comprehensive or accident.

What Does Can I Negotiate A Car Settlement With An Insurer? - Law ... Do?

https://www.youtube.com/embed/j786W8judN0Take note that each insurance company uses various criteria for stating that an automobile is an overall loss. A cars and truck that's amounted to by one insurance company probably would be totaled by another.

AboutUnknown Facts About What If The Other Driver Doesn't Have Insurance?

That means that how much you can recover financially depends on the percentage of fault you might share for the vehicle mishap.

Due to the fact that you're not at fault, you have the chance to sue with the at-fault chauffeur's insurance coverage company. Who's at Fault? How do you know if you're not at fault? Fault is something the insurer will often argue about. Because Indiana is a comparative fault state, you can bear a small percentage of fault and still recuperate financially through insurance coverage.

You're not the insurance business's direct client, so you might have to deal with long wait times and a discouraging consumer service experience. Legal Effects for Driving Without Insurance coverage Finally, filing with an insurance coverage company does not mean you get out of dealing with legal repercussions for driving without insurance coverage in the first place.

7 Simple Techniques For California Driving Without Insurance - Mcelfresh Law - San ...

However, if you have no insurance coverage and you're the at-fault chauffeur, this puts you in a tight area. Not just will you face legal consequences for driving without insurance in Indiana, but you'll also have no easy avenue for financial healing. Due to the fact that you're at fault, your lack of insurance coverage impacts not just your capability to recuperate, but likewise the other driver's.

Let's say you get into a cars and truck mishap and neither you nor the other driver has insurance coverage. What's essential when filing a claim versus a chauffeur directly is to make sure that driver has the personal financial resources to cover your damages.

If the at-fault motorist is broke, suing them will not do much excellent. In many automobile mishaps, fault is feasible. Either blame isn't clear, or both celebrations might bear partial responsibility for the vehicle mishap. Stories modification, and someone who asks forgiveness profusely at the scene of a cars and truck accident may later insist they not did anything wrong.

3 Simple Techniques For What If I Am In A Car Accident And Don't Have Insurance?

Our vehicle accident attorneys can examine the specifics of your accident, explain your alternatives to you, and figure out how best to continue with your case. Call us today at 317-472-3333, or contact us online for a totally free discussion about your claim.

You're driving along minding your own company when another lorry hits you out of nowhere. They're not paying attention to the roadway because they're on the phone, in an argument, or talking to their kids, or perhaps they aren't following the guidelines of the roadway.

The authorities will pertain to the scene of the mishap and submit a report. This report will specify who is at-fault, which's the chauffeur responsible for the damages and injuries during the mishap offered it occurred in a state without a no-fault insurance guideline. Once the mishap happens, the cops arrive, declarations are taken, and insurance coverage details is exchanged.

5 Easy Facts About What Happens If My Car Gets Hit By Somebody Who Doesn't ... Explained

If the other motorist does not have insurance coverage, it's up to you to pay for the damage they triggered. You'll call your insurance coverage company to file the claim, and they'll pay for your medical bills and any damage to your cars and truck that needs repair work supplied you have uninsured vehicle driver protection.

Most of the time the other driver can not pay for to spend for the damages. They probably can't even afford their insurance, which is why they let it lapse or expire. Suits, So long as you do not live in a no-fault state, there is an alternative that allows you to file a suit.

There's a little problem with this, and it's that the other chauffeur probably can't pay for to pay you regardless. In a lot of states, you can only sue the motorist of the other lorry if you sustained major damages. This suggests filing a lawsuit to have your automobile fixed to the tune of $3,000 isn't going to suffice unless you have sufficient medical expenses and dreadful injuries.

Getting My Uninsured Drivers - Oregon State Bar To Work

If you win the case and a judgement is put against the at-fault chauffeur, there's no warranty you will ever get any cash from that person. The court could put a lien on their house so if they ever offer, they are required to pay you prior to filching any earnings.

There are so numerous restrictions in place for those who can not pay for to pay, you may never ever see anything. The best thing anybody can do to safeguard themselves in the instance a mishap is brought on by a driver without insurance coverage is carry uninsured or under-insured vehicle driver coverage. If you aren't sure this is enough and wish to know what your legal choices are, you can call a Los Angeles Cars and truck Mishap legal representative to learn what rights you have in a mishap of this nature.

There's not a lot you can do when the other chauffeur hasn't an insurance coverage, but you do have rights you can enact if this should happen to you throughout an accident.

Not known Incorrect Statements About What Happens When You Get Into A Car Accident With No ...

Vehicle Insurance coverage is a major expense of automobile ownership, however it is considered so crucial that the majority of states need coverage by law. Not all 50 states need coverage, and many states offer options to insurance coverage company coverage. Even in the states without any cars and truck insurance requirement, it's not good to give up automobile insurance protection, since those states don't permit car owners to leave the costs of a mishap.

Key Takeaways Cars and truck insurance coverage is so crucial that a lot of states need coverage by law, but not all states mandate it. If you do not desire to have pay for insurance coverage, you'll likely have to show evidence of financial obligation.

You're not affected by shifts in insurance rates. Cons to No Vehicle Insurance coverage Any money conserved by not having insurance could be lost if you get into an accidentyou're still financially accountable for damages. Virginia citizens can skip getting car insurance coverage if they pay the state $500 per year.

The driver will buy the bond for the quantity required by the state. If there is a mishap, the bond covers the expenditures up to its limitation. The chauffeur then must pay back the money paid. The bond is associated with the drivernot the carso that the bond buyer can drive any automobile.

The motorist will buy the bond for the quantity required by the state. If there is an accident, the bond covers the costs as much as its limitation. The motorist then should pay back the cash paid out. The bond is associated with the drivernot the carso that the bond purchaser can drive any lorry.

Driving Without Insurance In New Jersey - Njsa 39:6b-2 - The Facts

https://www.youtube.com/embed/cgbyYkgfUtkThe motorist will purchase the bond for the quantity needed by the state. The motorist then must repay the money paid out.

AboutSee This Report about Accidents With No(or Not Enough)car Insurance - Iowa Legal ...

The cash we make helps us provide you access to free credit history and reports and helps us create our other terrific tools and academic products. Payment might factor into how and where products appear on our platform (and in what order). Because we typically make money when you discover a deal you like and get, we try to reveal you offers we think are a great match for you.

Naturally, the offers on our platform don't represent all monetary items out there, however our objective is to reveal you as numerous fantastic alternatives as we can. Even if you're a cautious chauffeur and do not believe you require vehicle insurance coverage, you should not put off buying it. Automobile liability insurance coverage is required in almost every state.

About one in 8 chauffeurs was uninsured in 2015, according to a 2017 research study by the Insurance Research Study Council. While being on the roadway without insurance can be dangerous, it can also be complicated if you enter an accident. Let's look at what occurs if you do not have car insurance coverage and trigger an accident or if you get into an accident with an uninsured driver.

Even if you're not at fault, you could still be penalized with fines, license suspension or even prison time (depending on your state) if you're captured driving without vehicle insurance coverage. Plus, without automobile insurance coverage, you may have to pay out of pocket for any related vehicle damage or medical costs.

Some Known Questions About Accidents With No(or Not Enough)car Insurance - Iowa Legal ....

In the majority of states, you 'd submit a claim with the at-fault motorist's insurance business. If another motorist hit you, you 'd file the claim with their insurer. However some states have no-fault laws, which suggests in the occasion of an accident, each motorist can sue with their own insurer to get coverage for injury claims without needing to determine who triggered the accident.

For example, in Louisiana, you can't sue for the first $15,000 of bodily injury or the first $25,000 of home damage. In other states, such as California and Missouri, you might be able to take legal action against for nonquantifiable damages if the other motorist was under the impact at the time of the accident.

In a lot of states, if you cause a mishap, your liability insurance coverage assists cover the other driver's automobile damage expenses and medical expenditures approximately your coverage limitation. But if you trigger an accident and don't have vehicle insurance coverage, you may be at threat of being taken legal action against by the other driver for the expense of damages.

While no-fault laws put limitations on when drivers can submit claims, you still aren't totally risk-free. Depending upon state laws, you might still be taken legal action against by the other driver. And remember, you 'd require to cover your own expenditures expense. Need car insurance? If you're guaranteed and enter into a mishap with a motorist who isn't, you may be able to take legal action against that driver to cover any associated medical expenditures or property damage.

An Unbiased View of What Happens If Your Car Insurance Lapses?

Uninsured or underinsured vehicle driver coverage is needed by more than 20 states and the District of Columbia.

While the majority of states require drivers to carry automobile insurance, some chauffeurs run the risk of getting on the road without that security in location. Depending on where you live, the repercussions of getting into a cars and truck mishap without any insurance coverage could be extreme. And when you do decide to buy vehicle insurance, you may end up paying more.

It depends. When you notify the other party's insurer of your claim, you ought to ask if you are entitled to payment for a rental vehicle or other alternative transportation. While the insurance company should inform you how much they would enable a rental car or other transportation, they do not need to devote to making any payments till it becomes reasonably clear that their insurance policy holder was legally accountable for the mishap.

Bear in mind that New Jersey insurance regulations need an at-fault chauffeur's insurance provider to compensate you for the expense of a rental car in proportion to their liability. If the insurance business permits $30 a day to lease a vehicle and their insured was found to be 60% at fault, they would just reimburse $18 a day to rent an automobile.

The Definitive Guide for When You Don't Need Vehicle Insurance - Citizens Advice

00 daily), the insurance provider must inform you where you can rent a lorry for that quantity. An insurance company is only obligated to repay you for a rental car, or other replacement transportation, for the duration of time up until the damaged lorry is fixed or, in the occasion of a total loss, up until the claim is settled.

In nearly every state in the U.S. the exception being New Hampshire you are needed by law to carry vehicle insurance coverage if you have actually a car registered in your name. The effects of not doing so vary from state-to-state but generally consist of fines and fees that are more expensive than vehicle insurance coverage premiums.

Let's take a better look at what takes place if you get caught driving without car insurance. Do you have to have insurance to drive?

The necessary quantities vary from state-to-state, the requirements for all states consist of the following: This covers medical expenses for injuries incurred by the people in the other car. It varies from $10,000 up to $50,000 per individual and $20,000 as much as $100,000 per accident, depending upon your state. This part of your policy covers damage to the other motorist's car and to any personal effects in the vehicle or that is harmed by the accident (such as a fence or light post).

The smart Trick of Having An Accident Without Insurance In California - Ca Auto ... That Nobody is Talking About

Some states also have other requirements, such as uninsured/underinsured driver coverage, medpay or injury defense (PIP). The latter two cover your medical costs in case of an accident and are compulsory in some states, optional in others. What are the effects of driving without insurance? What occurs if you drive without car insurance coverage differs based on a variety of elements, consisting of the state you remain in when it happens, and whether this is your very first or a repeat offense.

What are the repercussions if you get pulled over without insurance coverage? In a lot of states, if you are pulled over for the very first time and you have no auto insurance, there will be a fine.

https://www.youtube.com/embed/s-60TqntlYw

You would then be accountable for towing costs and other expenses included and might not be able to get your vehicle back until you have evidence of auto insurance. It's not likely to occur with a very first offense, many states also schedule the right to prison you for driving without auto insurance coverage.

AboutThe 7-Minute Rule for Why You Should Never Drive Without Car Insurance

"It's possible that you might not even get a ticket for this, as long as the officer can use your tag and registration to verify your insurance coverage."If you get into an accident and can't supply evidence of insurance, it's a comparable situation. The authorities will be able to verify your insurance coverage at the scene.

Needless to say, if you don't keep proof of insurance coverage on hand, you ought to put the proper documentation in your vehicle as soon as possible. Lots of significant insurer have a mobile app that enables you to download and see your ID cards right from your phone. In many states, electronic evidence of insurance coverage is acceptable if police demands it.

Is Automobile Insurance Required? If your state needs automobile insurance, it is unlawful to drive without the minimum coverage. Why do you have to have cars and truck insurance?

Your state may require various levels than other states for residential or commercial property damage liability and bodily injury liability. While lots of drivers might select low-cost vehicle insurance that just covers the state minimum insurance coverage limits, this choice might leave a chauffeur paying for expenditures out of pocket in case of a mishap.

The smart Trick of How Police Catch Uninsured Drivers - Getjerry.com That Nobody is Discussing

Liability insurance can offer home damage protections in case you struck a neighbor's mailbox or a parked car, while medical payments coverage can help pay health insurance deductibles. Why Do I Required Vehicle Insurance?

Automobile insurance is lawfully needed in a lot of states. If you do not have vehicle insurance coverage where it is lawfully needed, you might receive a fine, your chauffeur's license might be suspended or you might be sentenced to jail time.

Get a Quote From The Hartford We have actually made it easy to get your state minimum vehicle insurance quote. We can likewise offer additional protection choices to keep you and your properties safe. The AARP Vehicle Insurance Coverage Program from The Hartford is here to help keep you secured on the roadway.

Often Asked Questions About Automobile Insurance Coverage Requirements Which States Do Not Need Automobile Insurance? New Hampshire and Virginia are the only states that do not require car insurance. If you live in one of these states and select not to purchase cars and truck insurance coverage, you might still be financially responsible for paying out of pocket for any damage in the event of an accident.

The 10-Second Trick For Non-owner Car Insurance - Progressive

It's crucial to find the right coverage instead of just getting cheap vehicle insurance. Having the ideal vehicle insurance safeguards you, your travelers and your home if you remain in an automobile accident. What Occurs When You Do Not Have Vehicle Insurance Coverage? If you live in a state that needs vehicle insurance coverage and you are captured driving with a lapse in automobile insurance coverage protection, you could: Have your driver's license and lorry registration suspended Be charged fees to renew your license or registration Have your cars and truck seized or hauled Face a social work fine Be arrested Pay more for insurance coverage in the future No matter where you live, if you remain in a vehicle accident and you do not have auto insurance coverage, you may have to pay of pocket for damages or medical costs.

Automobile insurance coverage is lawfully needed in practically every state, but the reality is, a lot of drivers don't follow the guidelines. Getting into an accident without insurance coverage is complicated, and it can come with heavy effects.

That doesn't imply New Hampshire motorists are completely off the hook for insurance coverage. Chauffeurs in the Granite State are required to bring something called proof of financial responsibility. It's basically an alternative kind of cars and truck insurance coverage that shows you can manage to pay for certain losses if you get included in an accident.

You're probably questioning what occurs if the individual at fault in a mishap has no insurance, whether it's you or another motorist. Here are the steps you should take in either situation: If you are at fault, If you trigger a mishap and don't have insurance coverage, let the other motorist or the reacting policeman know you are uninsuredyou do not require to offer a specific reason that.

The Only Guide for What Happens If The At-fault Party Doesn't Have Car Insurance?

In a lot of cases, the other chauffeur's insurance coverage company will compensate you for a part or the overall cost of your losses. If you want to take the other driver to court, discover out how long you have to submit a claim after the mishap. Many states have a 3 year time period when you can go to court and settle with the other motorist after a crash.

However, the penalties vary by state, and depend on who caused the accident. If you are at fault, In addition to paying the other motorist's losses out-of-pocket, you will likewise have to pay a fine to the state's DMV.Your car might be seized. You could lose your driver's license for a time period.

2nd or third offenders might deal with jail time or required neighborhood service. If you are not at fault, You might have to pay a fine to the state's DMV.If it's your 2nd or 3rd offense, you might have your license suspended or your vehicle impounded, even if you didn't trigger the crash.

How not having proof of insurance makes a difference, All chauffeurs need to carry proof of insurance in their automobile at all times. If you enter a mishap or get pulled over, an authorities officer will ask you to supply your evidence of insurance documents. Nevertheless, some motorists get stuck in a scenario where they have insurance coverage, but no evidence of coverage.

The smart Trick of Faq: Auto Insurance, Claims, Coverage Issues, And More That Nobody is Talking About

If you bring a minimum of the minimum quantity of car insurance coverage required in your state, but don't have proof of insurance at the time of a mishap, the consequences are less severe than being totally uninsured. If this occurs, there are other ways that the authorities can validate your insurance coverage status.